Trading has been my interest for a long time. For more than 5 years, I’ve been personally interested in investing. It all started with a thorough search for a brokerage firm that could not only meet my immediate needs but also help me achieve my long-term objectives.

I had been asking my friends and family for their thoughts on various brokerage firms for whom they had served, weighing the advantages and disadvantages of each when considering my personal needs.

One of the most important concerns when trading digitally is the protection of the systems in use. When I was looking for a trading partner, this was a crucial factor for me to consider. During my quest for a reputable and trustworthy brokerage firm, I came across RosewoodTrust.

RosewoodTrust is a full-service investment service that supplies expertise and technologies to a wide range of clients, from self-directed active traders to those seeking financial advice. It offers a wide range of channels to select from, as well as full banking services. RosewoodTrust has quietly improved core elements of its mobile-responsive website, all while pledging to keep its clients’ investment costs down.

The business aims to be linked to as many electronic exchanges as possible. I was able to exchange equities, stocks, and futures from anywhere in the world at any time.

RosewoodTrusts’ order execution engine constantly monitors market dynamics in order to re-route any or portions of the order for optimum execution, price improvement, and discount maximization.

Derivatives, according to RosewoodTrust officers, pay for more than 90% of their customers’ trades, but equity and futures brokers have a multitude of options. All is in place to assist me in calculating risk and benefit opportunities. It’s just a matter of making decisions and acting on them.

RosewoodTrust is a simple, customer-focused investment company that provides good trading conditions to me. After its inception, CFDs on FX, Indices, Stocks, Crypto, and Commodities have been offered to retail and institutional clients all over the world.

Although website design isn’t the most critical part of trading, it is something I need to think about at the moment. It’s cutting-edge, with a slew of practical features and animated graphics. Of course, a trading site is much more critical than a landing page, but we will all agree on one thing: something that is visually appealing adds to the overall experience. Aside from that, the website is mobile-friendly and optimized, so I could trade on any smartphone. If I had to give this section a score, I’d give it a ten out of ten.

Even if I was visiting this broker for the first time, the platform it uses is new, but it is simple to use. The menu bar is on the left side, and it is split into parts. Relevant items such as Positions (open and closed), Deposit icon, Support, and so on can be found there. Assets are in the centre, and I could pick which category (Forex, Commodities, Crypto, Stocks, Indices) I wanted to invest in.

Table of Contents

Education

If you choose, you should skip the site’s schooling section and go right to the trading section. However, I felt like my knowledge needs to be updated, and I wanted to start learning about online trading from the ground up, RosewoodTrust had me covered. It provided me a lot of resources that were really good quality instruction. Every last bit of it has been divided into many sections for ease of use, and the vast majority of it can be used without registering. I’d love to see this instruction implemented in the rest of the trading platforms as well so that traders aren’t pressed to invest until mastering the ropes.

The Education Center is next to the Trading Platform on the main menu. New tabs will appear when you open them. eBooks, Asset Index, Frequently Asked Questions, and Glossary are all options.

eBooks are the thing that fascinates me the most. There is a wide range of subjects to choose from, but even though you have a lack of expertise, you can find something useful. Though the eBooks are beginner-friendly I wish they had more in their collection for the advanced traders.

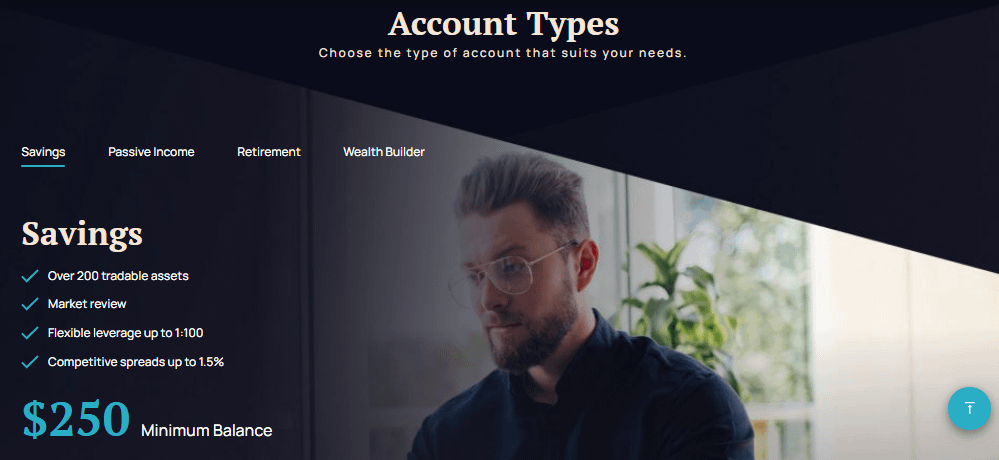

Account Types

This RosewoodTrust analysis would be incomplete if I didn’t devote a section to Account Types and general trading conditions. There are four main profiles, each with its own set of features and benefits. Choosing one of them was entirely up to my trading appetite.

If you’re a beginner, a Savings Account is a great place to go. There will be over 200 tradable securities available to you, with leverage up to 1:100, premiums up to 1.5 percent, and business ratings. The only stipulation is a $250 minimum fee. You get outstanding stuff for that price.

Then there’s the Passive Income Account. This time, the leverage is 1:200, spreads are up to 1%, and you’ll get tier-3 trading room research, monthly webinars, an incentive fund, financial preparation, and more. Any of this is available if you make a deposit of at least $5,000.

The third is a retirement account. You must invest a minimum of $20,000 this time, and if you do, you will get leverage of 1:300, spreads of up to 0.5 percent, webinars, and tier-2 trading room review.

This broker’s last account is called Wealth Builder. I deposited $100,000 in this account, I got ultra-tight spreads of up to 0.3 percent, a $5,000 bonus, invitations to VIP parties, and equity of up to 1:400. It was really interesting to see the upgrades I got with this account type and I don’t regret making this decision.

Support Centre

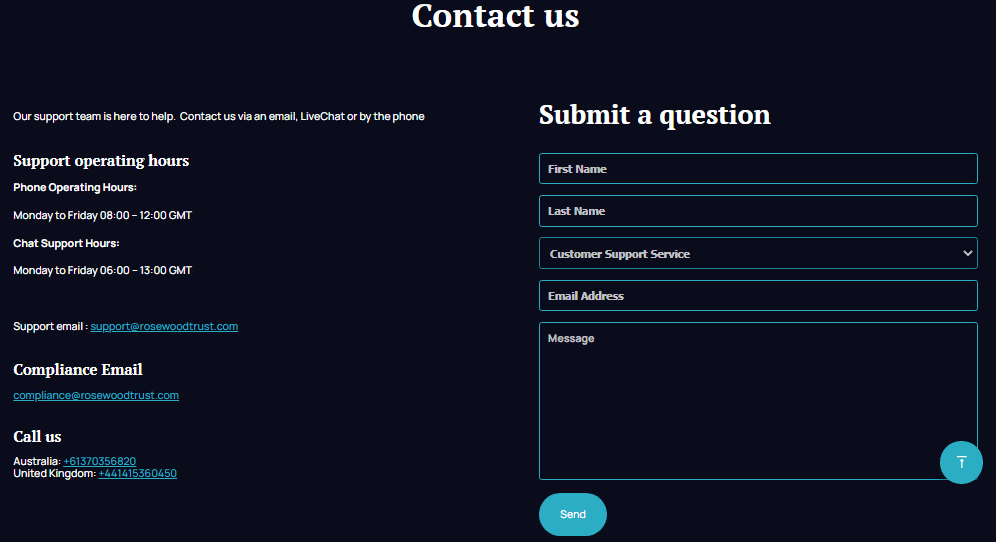

Perhaps a professional trader can understand the true value of a good support network. For a broker, finding problems or simple questions is inevitable, and getting a good team ready to respond is the make-or-break point for others.

In this sector, having the option to quickly send the message and make it hit the right people in a timely and successful manner is dramatically undecimated. Fortunately for all, RosewoodTrust claims to have invested heavily in developing a capable customer service team. They have a few different ways to reach them.

If I ever needed something resolved quickly, I always went to contact them right away. I could contact one of two squads, one in Australia and the other in the United Kingdom. I called both of them and received the same level of polished professionalism and politeness. Regardless of what I threw at them, they had the experience to do it gracefully.

When I was unable to speak with them directly due to a variety of circumstances, I could contact them by email or the on-page form. Regardless of how complicated the problem was, I still received a response within hours with the solution I was looking for. Traders should have the following hours in mind:

Visit Operating Hours:

Monday to Friday 07:00 – 14:00 GMT

Telephone Support Hours:

Monday to Friday 09:00 – 13:00 GMT

Deposit, Withdrawal & Refund Policy

Transparency is something I consider important. It’s rare these days to see a broker that posts all important documentation on their website, so I was shocked to see RosewoodTrust’s Legal Documents list.

I found all of the relevant details about commissions, promotions, and withdrawals on the inside. When I opened my account and planned to pay it, I had the option of using Credit Cards, Bank Wire, or Bitcoin Transfers. Keep in mind that withdrawals are made using the same form as deposits, so make your decision carefully.

I personally never faced a problem in this department, but I will say that the platform does not have a PayPal option for transactions, and they could work on it. Other than that, my withdrawals have always been on time and I never had to worry about my funds getting stuck. RosewoodTrust makes sure that this process never worries anyone.

Assortment of Payment Methods

Unlike most other RosewoodTrust features, payment methods are attracting some buzz. They essentially have the broker level and don’t go beyond that. Debit cards, wire transfers, and Bitcoin transfers are the only options available.

You may only choose one, but keep in mind that the amount of time you spend waiting varies greatly depending on the approach you choose. Although using MasterCards or wire transfers is generally thought to be a more reliable method. I have always used Bank Wire and MasterCard alternative and they have been great. I am just surprised as I have mentioned above that they don’t have a PayPal option available. But I’m sure that being a diverse platform that they will add to PayPal very soon.

Take Away

I have to admit, as I came to the end of this RosewoodTrust study, I was pleasantly shocked by what I discovered. RosewoodTrust is a trader I fully support and trust, and I hope this analysis has clarified that for you.

Disclaimer: This review is written from my own experience and my self-knowledge only and this is not a recommendation.

Be First to Comment