Life insurance is an important consideration for people of all ages. Annual renewable-term life insurance provides an affordable, simple way to ensure that you and your family are kept safe in the event of a tragedy. This type of life insurance is renewable on an annual basis, offering coverage for one year at a time. It also offers low premiums and flexible policy options, making it a great choice for those who want to protect their loved ones without breaking the bank

Table of Contents

Price & Coverage

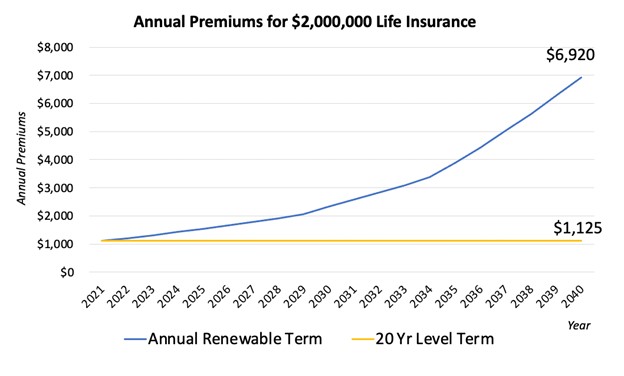

Annual Renewable Term Life Insurance is an affordable option for individuals who need short-term coverage. The policy is renewable every year, which gives the insured the flexibility to make adjustments to their coverage based on their needs. The premiums increase annually as well, making it a less attractive option compared to other term life insurance policies that offer fixed premiums.

When considering the price and coverage of annual renewable term life insurance, it’s important to factor in your age and health status. Premiums are based on these factors, so older or sicker individuals may see a significant increase in cost each year. However, this type of policy can be appealing for those who want coverage for a specific period but aren’t sure how long they’ll need it. If you are searching for insurance contact Art Life Insurance to get the best rates for your term life insurance.

Limitations

For starters, the premium rates will increase every year as you get older. This means that if you plan to keep your policy in place for many years, the cost of the policy may become unaffordable over time.

Another limitation of annual renewable-term life insurance is that it does not accumulate any cash value. This means that if you do not pass away during the term of your policy, you will not receive any money back. Additionally, there is no option to convert this type of policy to a permanent life insurance option.

It’s also worth noting that annual renewable term life insurance generally only covers death by natural causes and accidents. If you die due to suicide or engage in high-risk activities like extreme sports or drug use, your beneficiaries may not be eligible for a payout from your policy. Therefore, it’s important contact insurance agent for carefully consider the limitations and exclusions of an annual renewable-term life insurance policy before deciding if it’s the right choice for your needs.

Considerations

When considering annual renewable-term life insurance, there are several factors to take into account.

- The first consideration is the length of coverage needed. This type of policy is ideal for those who only need coverage for a short period, such as one year. However, if longer-term coverage is needed, it may be more cost-effective to explore other options.

- Another important factor to consider when choosing an annual renewable term life insurance policy is the premium cost. While this type of policy may have lower premiums initially, they can increase significantly each year as the policy renews. It’s crucial to understand these potential increases and ensure that they fit within your budget in the long run.

- Lastly, it’s essential to review the renewal terms and conditions carefully before committing to an annual renewable-term life insurance policy. Some policies may require a medical exam or underwriting at each renewal point, which could result in higher premiums or even denial of coverage altogether. Therefore, it’s crucial to understand all aspects of the policy before making any commitments and ensure that it aligns with your future financial goals and needs.

Conclusion

In conclusion, when it comes to purchasing annual renewable-term life insurance, it is important to evaluate all of your options. While this type of policy may seem like the most affordable option at first glance, certain drawbacks should be considered before making a final decision. For example, because the premiums increase each year with age, this type of policy may not be sustainable over time for those who plan on keeping their coverage long-term.

One alternative to consider is level-term life insurance which offers a fixed premium for a set period such as 10, 20 or 30 years. This allows you to lock in a lower rate and avoid potential price increases as you age. Additionally, some policies also offer conversion options that allow you to convert your policy into permanent life insurance without having to undergo an additional medical underwriting.

Ultimately, choosing the right life insurance policy requires careful consideration and evaluation of all available options. It is recommended that you speak with an experienced agent or financial advisor who can help guide you through the process and determine which type of coverage best fits your individual needs and budget.

Be First to Comment